10 Tax Write-Offs for Burlesque Dancers

This post may contain affiliate links. Read about our privacy policy.

It’s tax season, and before you get your tatas in a twist over the seemingly endless list of exceptions, policies, and procedures required by the good old IRS and US of A, here are a few tips on how to tackle your taxes this year.

If you have made your Burlesque career official (as in, you filed the paperwork with the government and actually pay taxes), then you might be surprised by the additional tax write-offs now available to you.

I am a HUGE fan of optimizing those tax write-offs!

Here is a short list of some of the deductions for which you might qualify (I am not an accountant or CPA, so please ask a professional before you get arrested):

- Dance classes and general education: If Burlesque dancing and performing is your career (or one of them), then you can absolutely write off career-related classes. From ballet to Broadway, cross-training to acting, you can deduct these expenses if they enhance your performance and career.

- Advertising. Headshots, business cards, posters and flyers, website development, audition tapes…all of these promotional expenses fall under advertising expenses and can deduct a huge chunk of your taxable income.

- Professional fees. Did you hire a lawyer? Assistant? Manager? Make-up artist? The amounts you paid to these professionals to help you maintain or promote your career can definitely be deducted.

- Travel expenses. Yes! This is one of my favorites! Did you travel for a show? An audition? Burly Con? The cost of attending these events (including flights, hotel, meals, etc.) can be a deductible expense as long as they meet the requirements. For more information, the IRS provides a full list of eligible business travel expenses.

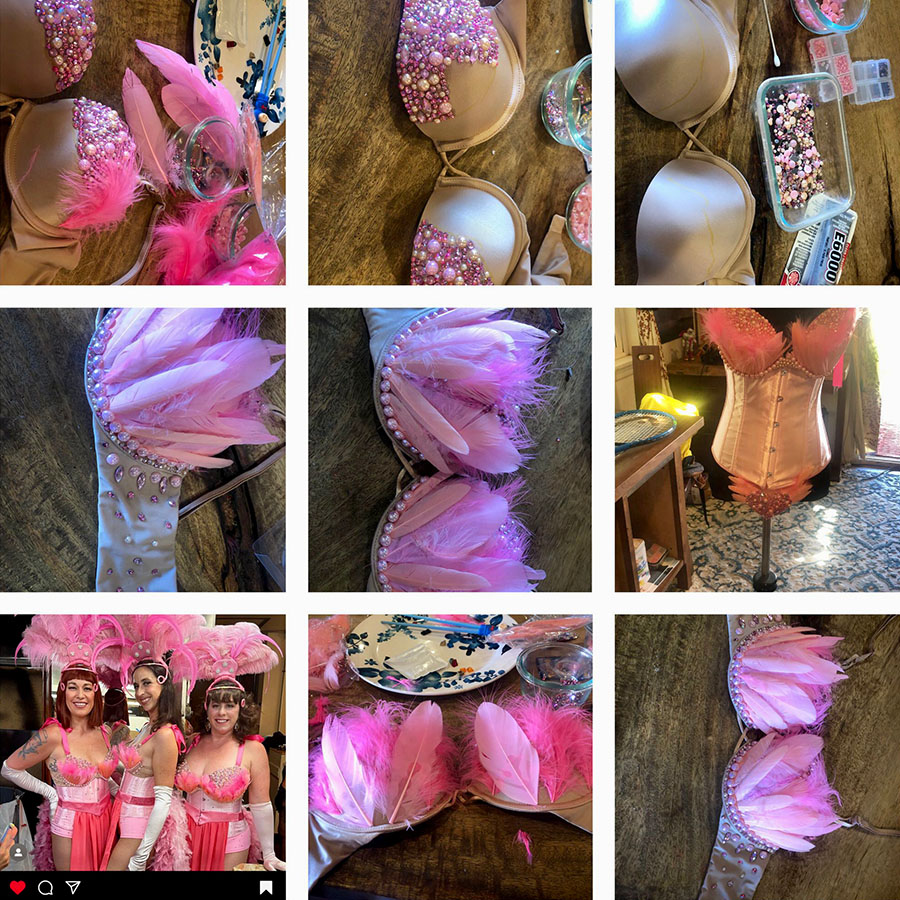

- Laundry. Yup, you can deduct laundry expenses—as long as it was for something like purchasing, cleaning, or altering a costume. The caveat here is the deduction must be for costumes required for your job, and not suitable for everyday wear—which, if your costumes are like mine, includes them all. I’m not wearing a giant fish head to the grocery store (though I did once wear a cat mascot head right after the mask mandate started…).

- Makeup. What? Did you know this? It’s true! Some makeup expenses can be deducted; however, you better have some strong proof that you can’t use them outside of stage life. Glitter lips and prosthetic adhesive? Check. Concealer and contour? No-go!

- Props. Set materials and props are tax-deductible, too! The same rules apply as above. If it’s your dining room chair, you can’t write it off as a stage prop.

- Insurance. Do you pay your own health insurance? Do you have business or general liability insurance for yourself? If so, you may be eligible to deduct up to 100% of your insurance premiums. Don’t miss this one! It could save you big!

- Food. No, you can’t write off the pre-show Starbucks or cocktails, but if you purchase food for the crew or host a post-production cast party, those bites might give you a bit of a tax break.

- Music. How can you have Burlesque without music? Um…you can’t, which makes it an essential component to your performance and career. If you used a service like Pandora, Spotify, iTunes, etc. you can include those purchases in your deductions (as long as they are used solely for your performance). If you use a subscription, just use your best guesstimate for the percentage of personal vs. business use. Things like CDs (ha!) would be considered “supplies,” whereas music services would fall more under “subscriptions.”

Did any of those surprise you? Are there any really important ones I missed? Of course, there are MANY, many more deductions available, but this list is just a taste of some of the Burlesque or performer-specific deductions I use every year. Good luck, and may the odds be ever in your favor!

Pro tip: Keep your receipts! No, really. When the IRS comes calling, you don’t want to be caught unawares. Take it from someone who has been audited MORE THAN ONCE! Keep. Your. Receipts.

Want to know what qualifies Bourbon Layne to talk about this if she isn’t a CPA? Find out!

Disclaimer: This post includes affiliate links, and I will earn a commission if you purchase through these links. Please note that I’ve linked to these products purely because I recommend them and they are from companies I trust. There is no additional cost to you.

This Post Has 0 Comments